Evergrande Stock Market Collapse - China Evergrande China S Nightmare Evergrande Scenario Is An Uncontrolled Crash The Economic Times

The concerns around Evergrande also triggered a nearly 10 sell-off in bitcoin usually seen as a safe-haven play during bouts of stock market volatility which spread to shares of crypto mining. Evergrande owes roughly 300 billion in debt and is the poster child of an overheated Chinese property market.

Evergrande Eyeing 5 Bln Property Unit Sale Rival Fantasia Misses Payment Reuters

Lehman filed for bankruptcy with 619 billion dollars in debt.

Evergrande stock market collapse. A managed default or even messy collapse of Evergrande would have little global impact beyond some market turbulence. What Is China Evergrande and Why Is Its Crisis Worrying Markets. The VIX has lingered around the 20 level in recent days pointing to elevated expectations for near-term stock market gyrations even as stocks remained close to record highs.

Stock market news The collapse of Evergrande one of Chinas largest home developers is not a Lehman moment but the fear may haunt steel and metal stocks in India. Roughly two weeks after we covered it the potential collapse of a major Chinese corporation now threatens to unravel the bull market. Could the collapse in Evergrande shares really cause a UK stock market crash.

Stock benchmarks were on track to post their worst daily drops in more than two months with the skid being blamed on the potential collapse of Evergrande. The Chinese property giants debt load is teetering. Heres a look at the crisis and the risks of a collapse.

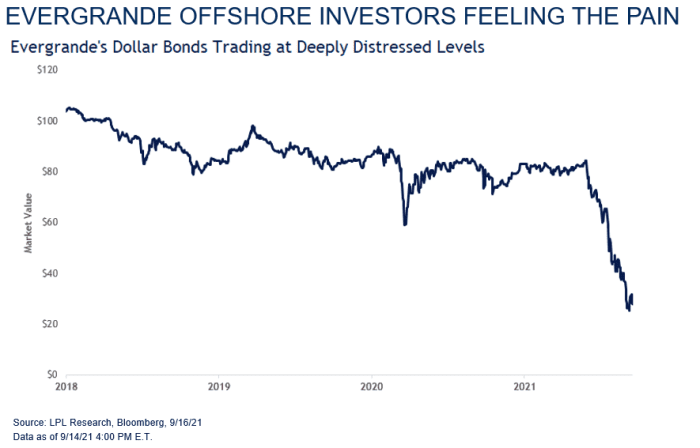

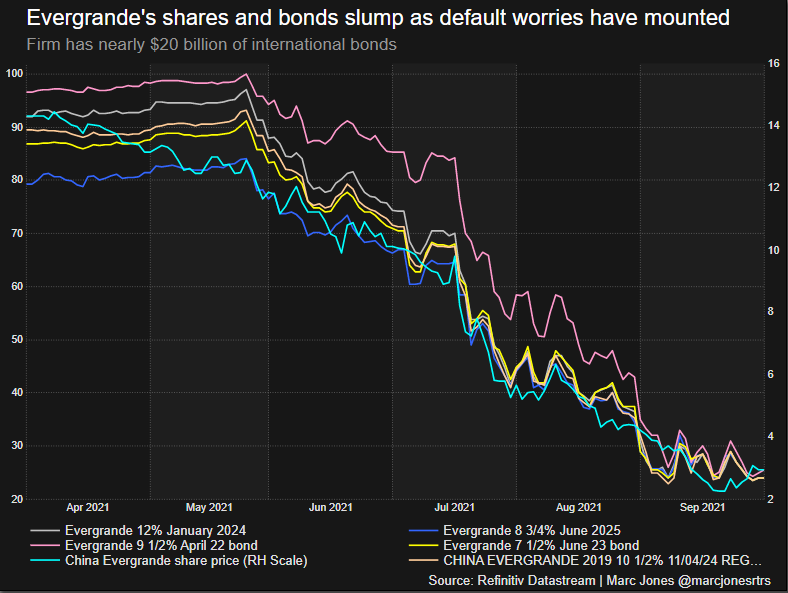

Evergrandes dollar bonds have collapsed. Evergrandes shares which trade on the Hong Kong Stock Exchange have spiraled down since late 2017 and on Friday closed at the equivalent of about 45 US cents. Analysts however are discounting the prospect of.

The entire US stock market immediately crashed setting off a global recession. Evergrandes bonds have been blacklisted and can no longer be used as collateral. A looming debt default by Chinese real estate titan Evergrande is sparking fears of global contagion and knocking stocks from their perches.

Its no wonder then that the prospect of default by Chinas Evergrande a massive real estate developer has everyone on edge. September has historically been a tough month for stocks and the SP has gone more than 300 calendar days without a selloff of 5 or more. The crippling repercussions of that dark time in economic history are still fresh in the worlds collective memory.

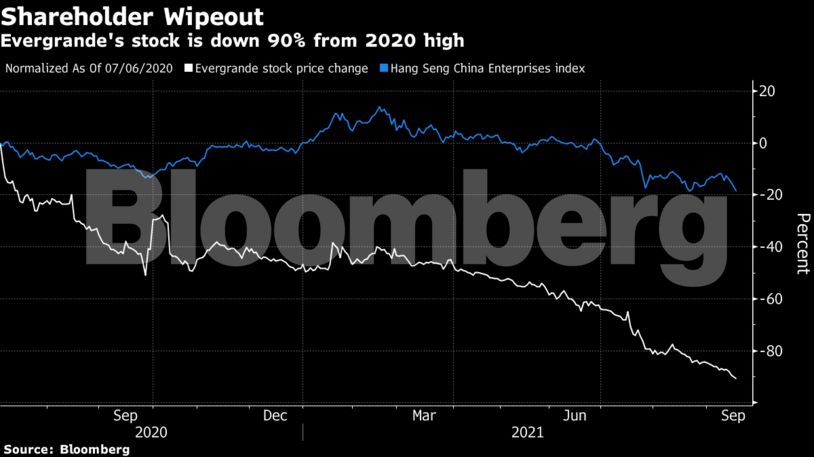

Andy Ross Wednesday 22nd September 2021. As troubles mounted for the company its shares melted significantly. Now Hong Kong billionaire Joseph Laus company a major shareholder in Evergrande Group has also hinted at plans to sell all of his stock in the ailing Chinese property developer.

The deteriorating financial condition of Evergrande has led to its stock falling nearly 80 year-to-date and its bonds trading at historic lows. Covid was to the 40 trillion fiscalmonetary stimulus cycle of 2020-2021 as Evergrande collapseChina real estate crisis will be to 2022-2023 zerohedge. The Dow Jones Industrial Average ended Mondays trading session down more than 600 points after steep stock market declines in Europe and Hong Kong and other parts of Asia.

The collapse of Lehman brothers in 2008 was a major catalyst which caused the Financial crisis stock market crash. 3333 shares slid after a deal to sell a 26 billion stake in its property services unit collapsed in its latest setback. How the Evergrande Crisis Is Punishing Global Stocks Evergrandes problems have coincided with waning investor appetite for stocks.

With algos busy chasing upward momentum in futures and global stocks the biggest if largely ignored story remain the ongoing collapse of Chinas Lehman the 300 billion China Evergrande where following our earlier reports see below that a bank run emerged among creditors of the biggest and most indebted Chinese developer as its bonds were no longer eligible collateral in the. Theres a lot of fear in the market right now because people are seeing this issue with this major property developer in China drawing Synergies. September 20 2021.

The Hong Kong market was closed on Wednesday when the deal was announced. Today Evergrandes market cap is down to 49 billion losing nearly 90 percent of its value. Founded in Guangzhou in 1996 Evergrande one of Chinas biggest developers is on the brink of collapse as it wallows in debts of more than 300 billion.

Evergrande Chinas second-largest real estate developer was well on the path to insolvency earlier this year. After a volatile day of trading Evergrande shares closed more than. Stock markets in China were expected to fall sharply on Wednesday on fears that Evergrande would fail to meet an offshore bond payment Jérôme FavreEPA via Shutterstock.

What is Evergrande. The financial crisis gripping major Chinese property developer Evergrande has triggered a sharp turn in broader stock market sentiment as seen by. First reported in Reuters Evergrande is teetering between a meltdown a managed collapse or the prospect of a bailout by the government.

Simon MacAdam senior global economist at Capital Economics said.

Wall Street Marks Biggest Drop Since May As Evergrande Crisis Intensifies Financial Times

Evergrande Sends Dow Down 800 Points What Investors Need To Know About China S Teetering Property Giant Marketwatch

Evergrande Ev Stock Loses 80 Billion In World S Worst Rout Bloomberg

Evergrande Isn T The Only Reason The Stock Market Is Headed For Its Worst Day In 2 Months Here Are 7 Other Reasons Marketwatch

The Biggest Losers In The Evergrande Crisis Beijing Will Decide Fortune

Why Stock Markets Are Plummeting Across The Globe Evergrande Collapse Explained

From Evergrande To Delta Variant 3 Things To Know About The Stock Sell Off Npr

Huge Credit Stress Starting In China May Easily Rock The Whole World Mish Talk Global Economic Trend Analysis

Now Evergrande S Ev Unit Warns Of Running Out Of Cash Business And Economy News Al Jazeera

Evergrande S Share Price Collapse The World S Biggest No Big Deal Default

The Evergrande Crisis Explained For Hkex 3333 By Michael Wang Official Todayuknews

China Evergrande Shares Fall Sharply After 2 6bn Asset Sale Collapses Evergrande The Guardian

Hong Kong Stocks Crash Futures Slide As Markets Finally Freak Out About Evergrande Default Contagion Nxtmine

China Evergrande China S Nightmare Evergrande Scenario Is An Uncontrolled Crash The Economic Times

Why Trouble At China S Evergrande Tanked The Stock Market

China Fear Spreads Beyond Evergrande Crisis Roiling Stock Markets Business Standard News

Evergrande Chinese Property Giant Warns Again That It Could Default On Its Enormous Debts Cnn

China S Debt Bomb Evergrande Is Causing The Stock And Crypto Markets To Collapse Non Stop Coincu News

China Evergrande China S Nightmare Evergrande Scenario Is An Uncontrolled Crash The Economic Times